Pacific Prime Fundamentals Explained

Pacific Prime Fundamentals Explained

Blog Article

Our Pacific Prime Ideas

Table of ContentsHow Pacific Prime can Save You Time, Stress, and Money.The 6-Minute Rule for Pacific PrimeSome Of Pacific PrimeMore About Pacific PrimeThe 4-Minute Rule for Pacific Prime

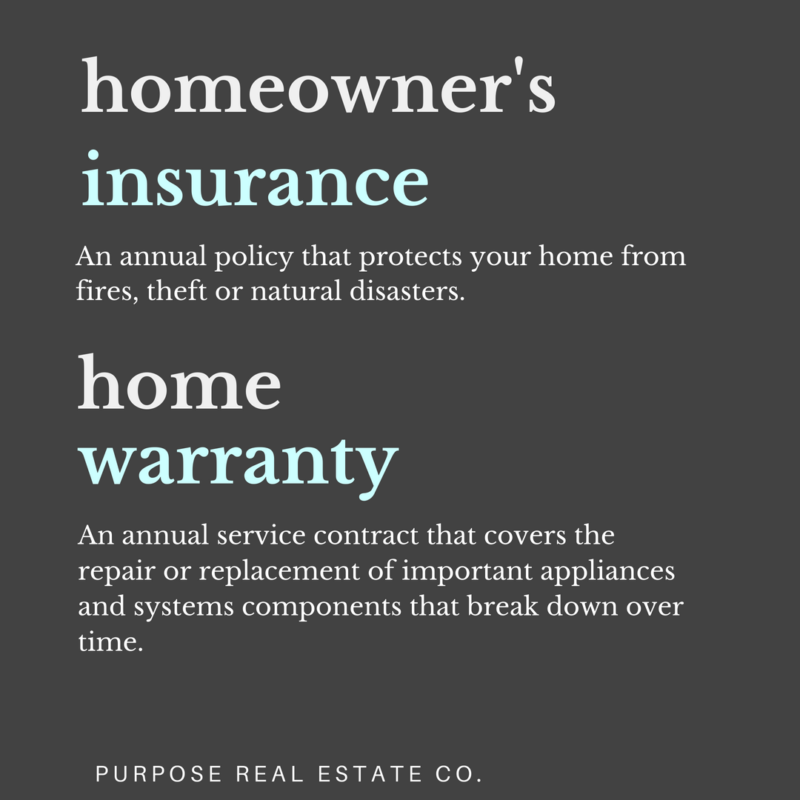

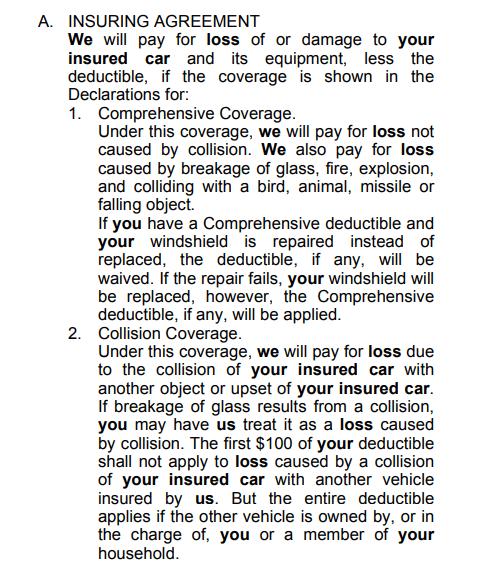

Insurance coverage is a contract, stood for by a policy, in which an insurance holder receives financial protection or compensation against losses from an insurer. The business pools customers' risks to make payments a lot more inexpensive for the insured. Many people have some insurance policy: for their automobile, their house, their healthcare, or their life.Insurance coverage likewise helps cover expenses associated with responsibility (lawful responsibility) for damage or injury created to a third event. Insurance is a contract (plan) in which an insurer indemnifies an additional versus losses from specific backups or perils.

Investopedia/ Daniel Fishel Numerous insurance coverage kinds are offered, and essentially any kind of specific or business can locate an insurance provider ready to insure themfor a rate. Typical personal insurance coverage policy types are vehicle, wellness, homeowners, and life insurance policy. Many people in the USA contend the very least one of these kinds of insurance policy, and auto insurance coverage is called for by state legislation.

Get This Report about Pacific Prime

Finding the rate that is ideal for you calls for some research. Optimums may be established per duration (e.g., yearly or plan term), per loss or injury, or over the life of the policy, additionally understood as the lifetime optimum.

Policies with high deductibles are typically cheaper because the high out-of-pocket expense normally causes fewer small claims. There are several kinds of insurance. Let's check out the most essential. Wellness insurance assists covers regular and emergency healthcare costs, frequently with the alternative to include vision and oral services individually.

Lots of precautionary services might be covered for totally free prior to these are met. Health insurance might be purchased from an insurance policy business, an insurance representative, the federal Medical insurance Marketplace, supplied by an employer, or government Medicare and Medicaid coverage. The federal government no more needs Americans to have medical insurance, yet in some states, such as California, you may pay a tax charge if you do not have insurance.

Some Of Pacific Prime

The business then pays all or many of the covered expenses connected with a vehicle mishap or various other lorry damages. If you have actually a leased car or obtained money to acquire a cars and truck, your loan provider or leasing car dealership will likely require you to lug car insurance.

A life insurance policy policy guarantees that the insurance provider pays a sum of cash to your recipients (such as a spouse or children) if you pass away. In exchange, you pay costs throughout your life time. There are 2 main kinds of life insurance. Term life insurance policy covers you for a particular period, such as 10 to twenty years.

Insurance policy is a method to handle your monetary risks. When you get insurance policy, you acquire protection versus unforeseen financial losses. The insurance coverage business pays you or someone you pick if something poor happens. If you have no insurance and a crash happens, you might be accountable for all related costs.

Everything about Pacific Prime

Although there are numerous insurance plan types, some of one of the most typical are life, health, property owners, and vehicle. The appropriate kind of insurance policy for you will certainly depend on your objectives and financial circumstance.

Have you ever before had a moment while taking a look at your insurance plan or buying insurance when you've assumed, "What is insurance policy? And do I really need it?" You're not alone. Insurance coverage can be a strange and puzzling point. Exactly how does insurance work? What are the advantages of insurance policy? And exactly how do you locate the best insurance coverage for you? These are common questions, and the good news is, there are some easy-to-understand solutions for them.

No one wants something bad to occur to them. Yet experiencing a loss without insurance policy can place you in a challenging monetary circumstance. Insurance is an essential monetary tool. It can aid you live life with less worries knowing you'll get financial help after a catastrophe or crash, helping you recuperate faster.

The Only Guide to Pacific Prime

And in many cases, like automobile insurance policy and employees' payment, you may be called for by regulation to have insurance in order to secure others - international health insurance. Find out about ourInsurance choices Insurance policy is essentially a big nest egg shared by several individuals (called policyholders) and handled by an insurance policy copyright. The view website insurer uses money collected (called premium) from its insurance policy holders and other financial investments to spend for its operations and to satisfy its promise to insurance holders when they file a case

Report this page